International student migration, about the government’s net migration target, has been the hub of considerable debate over the past few years. After the US, the UK has become the main attraction for many international students each year now. With an overwhelming number of international students coming to the UK in 2018, in particular, now is a great time to invest in their accommodation.

The trend doesn’t seem to be diminishing anytime soon

It has been observed that since 1992, the number of students making their way to the UK has almost doubled up. This means that any investment made in property options meant to facilitate them is bound to yield strong, promising results.

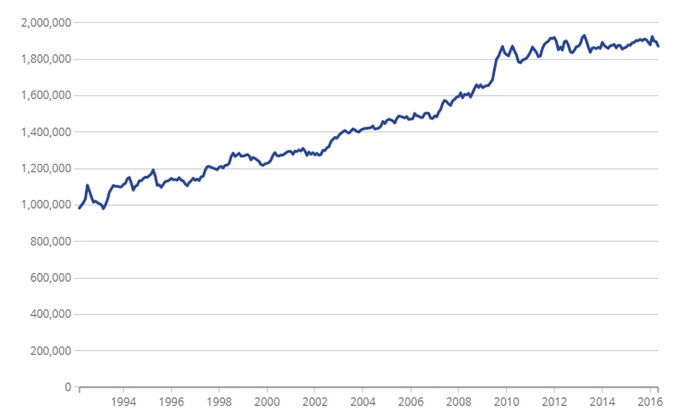

The chart beneath shows the number of people aged 18 to 24 in full-time education in the UK from March-May 1992 to May-July 2016 according to the Labor Force Survey.

The significant rise in the curve is a true depiction of how many international students the UK gets to entertain in the recent times. The increase is constant and rapid which further goes out to prove the gap in the demand and supply market for student accommodation that this trend will be created. Hence creating room for investments.

Currently, Singapore is leading the downpour of investment with firms like Mapletree and GIC, spending a total of £1.2bn on UK student housing in 2016. A favourite investor of Asia is UK student housing because UK higher education is tangible for them.

Moreover, according to the data gathered by Universities UK International, 91% of international higher education students were pleased with their university experience in the UK, and this led to the country experiencing a 2.2% rise in applications from overseas students. This figure, however, doesn’t include the EU students that have shown their interest since 2016.

The table below shows the statistics of students both international and non-international all over Europe.

| Country | Total EU students (not including the UK) | Total non-EU students | Total international students | % of the student population who are international |

| England | 98,460 | 261,275 | 359,735 | 19% |

| Scotland | 20,945 | 29,980 | 50,925 | 22% |

| Wales | 5,460 | 16,730 | 22,190 | 17% |

| Northern Ireland | 2,570 | 5,160 | 5,160 | 9% |

| UK | 127,440 | 310,570 | 438,010 | 19% |

If you are interested in investing in buy-to-let rentals in university towns, then I can guarantee that you won’t be at a loss, given that you look for the areas with promising yields.

According to a research it was seen that Oxford has the lowest yield of merely 3.33% whereas the highest buy-to-let yield lies in St. Andrews. As long as you continue to provide affordable living solutions, the demand for the property options you have to offer won’t seize anytime soon.